Overland Flood Protection in Manitoba

Here in Manitoba, we’re no strangers to unpredictable weather. The recent rise in severe weather has many people wondering: is my home truly protected?

One often overlooked risk is overland flooding. This happens when water enters your home from the ground up, caused by heavy rains, snowmelt, water main breaks, and blocked ditches. You don’t need to live beside a river or lake to experience flooding.

Peace of Mind for Manitoba Homeowners

At Guild Insurance Group, we understand the importance of feeling secure in your home. It’s your sanctuary, your haven from the outside world. The last thing you want to worry about is the potential for a flood to devastate your peace of mind – and your finances.

That’s why we want to be your partner in navigating the world of insurance, and that includes overland flood coverage. Think of it as an extra layer of protection, a shield against the unexpected. With overland flood insurance, you can face a flood situation with a sense of calm, knowing you have the financial backing to recover.

Why Consider Overland Flood Insurance?

Manitoba’s climate can be a double-edged sword. Heavy rains and rapid snowmelt are a reality, and with overland flooding, even basements far from rivers or lakes can be vulnerable. Having this additional coverage can give you peace of mind knowing you’ll have financial help if your home is damaged.

Canadians who have experienced overland flooding emphasize the importance of having flood insurance. They advise understanding exactly what your policy covers.

Here’s the Breakdown:

- Overland Flood Coverage: Covers you when you have water entering your home from the ground up, due to heavy rain, snowmelt, or water main breaks.

- Cost: Typically ranges from $100 to $300 per year, depending on your risk location.

- Coverage: Often covers up to $10,00 in damages.

Empowering You with Knowledge

We know insurance can be complex. That’s why, here at Guild Insurance Group, we’re passionate about client insurance education. We’ll work with you to understand your unique situation and explore all your options, including additional coverage for overland flooding.

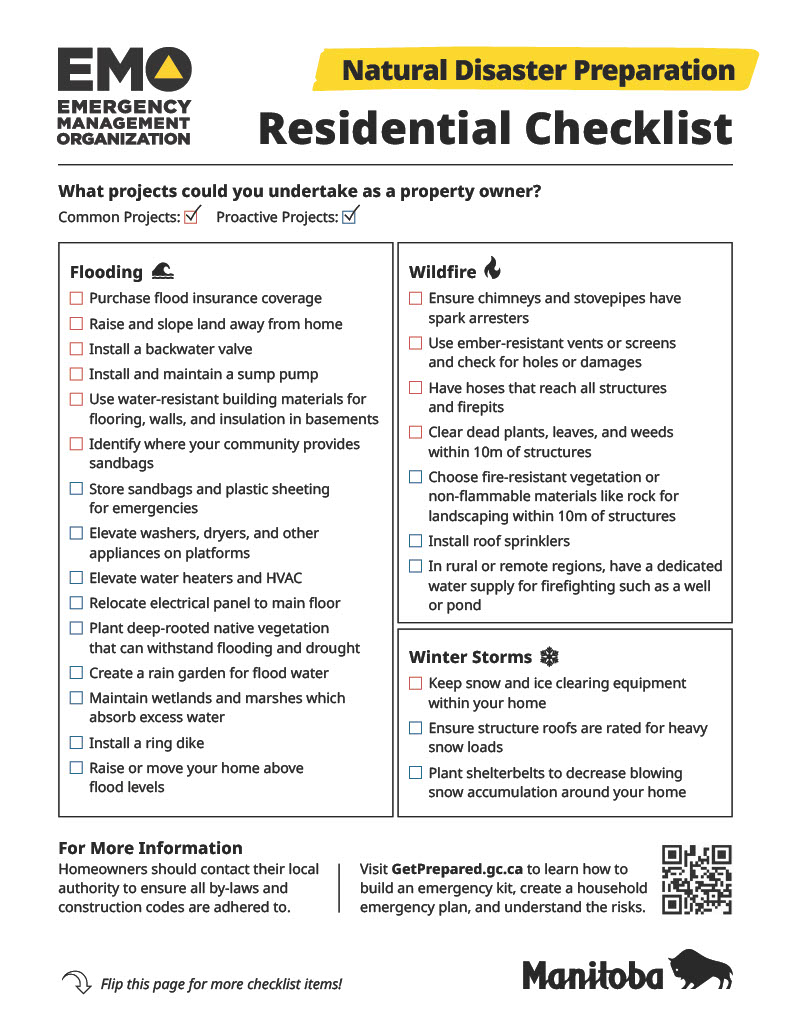

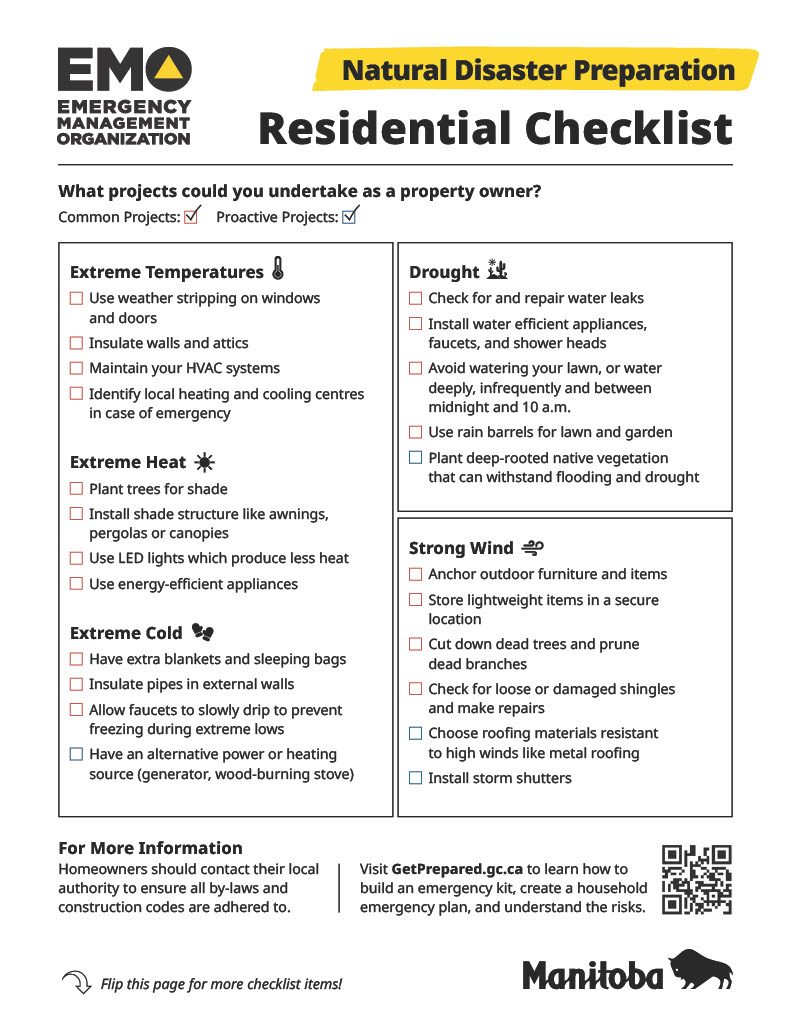

Be Prepared: Proactive Projects for Homeowners

While overland flood insurance is a crucial step, there’s more you can do to protect your home. Here’s a checklist to get you started:

- Project 1: Secure Coverage: Purchase flood insurance coverage.

- Project 2: Grading Defense: Raise and slope land around your home to divert water away from the foundation.

- Project 3: Backwater Blockade: Install a backwater valve to prevent sewage from entering your home.

- Project 4: Sump Pump Savior: Install and maintain a sump pump to remove excess water from your basement.

- Project 5: Flood-Resistant Basement: Use water-resistant building materials for flooring, walls, and insulation in your basement.

Additional Tips:

- Identify where your community provides sandbags and plan to store them for emergencies, along with plastic sheeting.

- Elevate washers, dryers, and other appliances on platforms to minimize water damage.

- Consider elevating your water heater and HVAC system to a higher floor.

Working with Nature:

- Plant deep-rooted native vegetation that can absorb excess water and withstand drought conditions.

- Create a rain garden to capture and filter rainwater, reducing runoff around your home.

- Maintain wetlands and marshes near your property, as they naturally absorb excess water.

In More Extreme Cases:

- For high-risk areas, consider installing a ring dike, a circular earthen embankment that acts as a water barrier.

- Raising your entire home or relocating it to higher ground may be necessary in some situations.

We’re Here to Help

The Manitoba Emergency Management Organization is changing the Disaster Financial Assistance (DFA) program. If you had the chance to purchase overland flood insurance but did not, the DFA program will not provide assistance where insurance was available. To learn more visit https://www.gov.mb.ca/emo/dfa/faq.html#aboutprog

Ready to chat about overland flood insurance or have questions about your home insurance policy? Our knowledgeable and friendly team is here for you. Give us a call, and let’s get you covered!

Remember: By taking proactive steps and having the right insurance in place, you can significantly reduce the impact of overland flooding on your Manitoba home.